Hey everyone! Ever found yourself staring at your investment portfolio, wishing for something more… something with a bit more punch than traditional savings, but still accessible?

I totally get it. In my own journey through the ever-evolving world of personal finance, I stumbled upon Peer-to-Peer (P2P) lending, and let me tell you, it’s been a game-changer for many.

We’re talking about a thriving, innovative space projected to see massive growth, driven by exciting tech like AI for smarter risk assessment and even blockchain for enhanced transparency.

It’s truly reshaping how we think about earning passive income and diversifying our assets. But here’s the real talk: while P2P lending offers the allure of attractive returns that can genuinely beat inflation, it’s definitely not a ‘set it and forget it’ kind of deal.

There are unique risks, from borrower defaults to navigating platform nuances, that you absolutely need to understand to protect your hard-earned money.

Crafting a solid financial plan isn’t just a good idea; it’s your secret weapon for maximizing those juicy returns and sleeping soundly at night. After years of exploring this landscape, I’ve learned that strategic planning is what truly separates the savvy investors from those just dabbling.

Ready to unlock the full potential of P2P lending for your financial future? Let’s dive in and truly master the art of smart P2P investment planning!

Mapping Your P2P Journey: Defining Your Financial North Star

You know, when I first dipped my toes into the P2P lending waters, I was incredibly excited by the potential returns. But what I quickly learned, and what I really want to impress upon you, is that without a clear destination in mind, it’s easy to drift.

Before you even think about which platform to join or how much to invest, you absolutely *must* define your personal financial goals. Are you saving for a down payment on a house, building a retirement nest egg, or just aiming for a consistent passive income stream?

Your goals will be the compass guiding every P2P decision you make. I remember one early mistake I made was just chasing the highest interest rates without really understanding if those high-risk loans aligned with my long-term, relatively conservative goals.

It led to some sleepless nights, I can tell you! Understanding your desired timeline and risk tolerance is equally crucial. If you’re looking for short-term gains, your strategy will look very different from someone investing for decades.

This foundational step isn’t just theory; it’s the practical bedrock that helps you build a resilient and effective P2P portfolio. It’s about being intentional, not just reactive, and truly understanding what success looks like for *you* in this exciting space.

Understanding Your Risk Appetite and Investment Horizon

This is where personal finance truly gets *personal*. We all talk about risk, but what does it actually mean for you? Are you the kind of person who gets anxious at the slightest market fluctuation, or can you ride out the storm for potentially higher long-term gains?

P2P lending has its own unique set of risks, like borrower default, and knowing how much of that uncertainty you can comfortably bear is paramount. My personal experience taught me that being honest with myself about my comfort zone, rather than trying to be a hero, paid dividends.

Similarly, your investment horizon – how long you plan to keep your money invested – heavily influences your strategy. Shorter horizons might push you towards more liquid, perhaps lower-yielding, options, while a longer horizon allows you to embrace more diversified and potentially higher-return, albeit riskier, opportunities, letting compound interest work its magic over time.

Setting Clear, Achievable Financial Milestones

Once you have your general direction, it’s time to mark out the milestones along the way. Think of them as smaller, manageable goals that build up to your ultimate financial north star.

For example, instead of just “make money,” try “generate $500 in passive income from P2P lending within the next year.” Or “diversify my P2P portfolio across 5 different loan types by Q3.” I’ve found that breaking down big goals into smaller, actionable steps not only makes them less daunting but also gives you tangible victories to celebrate, which is a huge motivator.

It also allows you to regularly assess your progress and make adjustments if necessary. My journey has definitely had its detours, but having those milestones helped me stay on track and course-correct when needed.

Navigating the P2P Landscape: Picking Your Platforms Wisely

Okay, so you’ve got your goals ironed out – excellent! Now comes the fun part, or what can feel like the overwhelming part: choosing where to actually invest your money.

The P2P lending market is brimming with platforms, each with its own niche, risk profile, and user experience. It’s not a “one size fits all” situation, and honestly, blindly picking the first platform you see advertising high returns is a recipe for potential heartache.

I can tell you from my early days, I spent way too much time chasing shiny objects before realizing that thorough due diligence is non-negotiable. Think of yourself as a detective, investigating everything from a platform’s historical performance and default rates to its regulatory compliance and borrower screening processes.

Some platforms specialize in real estate loans, others in personal loans, and some even in business financing. Understanding these nuances is critical to aligning your investments with your risk tolerance and financial objectives.

This is where your homework really pays off, ensuring you’re placing your trust and your money in a robust and reputable environment.

Deep-Diving into Platform Due Diligence

When I evaluate a new P2P platform, I essentially become a financial sleuth. My checklist is extensive: I look at their operational history, how long they’ve been around, and what kind of reputation they’ve built.

I scrutinize their borrower vetting process – how do they assess creditworthiness? What are their default rates, and importantly, how do they handle defaults?

Is there a provision fund, for instance? Regulatory compliance is another huge one; you want to ensure the platform operates within the legal framework of your region.

I also pay close attention to their fee structure – sometimes seemingly small fees can really eat into your returns over time. It’s about understanding the entire ecosystem of the platform, not just the advertised interest rates, because those often tell only part of the story.

Comparing P2P Platform Features and Offerings

It’s genuinely fascinating how diverse P2P platforms have become. Some offer auto-invest features, which are great for hands-off investors like me, who appreciate the automation once the initial settings are configured.

Others provide secondary markets, which can offer liquidity if you need to sell your loans before maturity – a feature I’ve personally found incredibly useful when an unexpected expense popped up.

Then there’s the range of loan types: consumer loans, business loans, real estate, even invoice financing. Each has its own risk-reward profile. For example, real estate-backed loans might offer more tangible collateral, potentially reducing risk, while unsecured personal loans might yield higher returns but carry higher default probabilities.

It’s about finding the sweet spot that matches your comfort level and investment strategy.

Building Your Financial Fortress: Mastering Risk Mitigation in P2P

Let’s be real, no investment is entirely without risk, and P2P lending is no exception. However, what separates the truly successful investors from those who stumble isn’t avoiding risk entirely, but rather *managing* and *mitigating* it effectively.

This is where your strategic planning truly shines. I’ve seen too many people jump into P2P, lured by high returns, without a solid understanding of potential pitfalls.

My own journey had its early bumps, where I learned the hard way that a diversified approach isn’t just a suggestion; it’s a critical shield against unexpected losses.

Think of it like building a financial fortress: you need strong walls, multiple layers of defense, and contingency plans for when things don’t go exactly as expected.

From understanding the nitty-gritty of borrower defaults to spreading your investments wisely, proactively addressing risk is the cornerstone of sustainable P2P success.

It’s about being prepared, not paranoid, and ensuring your hard-earned capital is as protected as possible while still reaching for those attractive returns.

The Power of Diversification: Not Putting All Your Eggs in One Basket

This might sound cliché, but in P2P lending, diversification is genuinely your best friend. I cannot stress this enough! My personal rule of thumb is to never put too much capital into a single loan or even a single platform.

Instead, spread your investments across numerous loans, different borrower types, varying loan durations, and even multiple platforms if you feel comfortable.

This way, if one borrower defaults or one platform faces an issue, the impact on your overall portfolio is minimized. I remember a time when a small portion of my portfolio was heavily concentrated in one type of loan, and when that sector hit a rough patch, I felt the pinch.

That was a huge learning moment. Now, I make it a point to diversify across at least 50-100 individual loans, often with small amounts in each.

Understanding and Mitigating Borrower Default Risks

Borrower default is the inherent risk in P2P lending – it’s the possibility that a borrower won’t repay their loan. While platforms do their best to vet borrowers, it’s an unavoidable part of the landscape.

What *you* can do is understand how each platform handles defaults. Do they have collection agencies? Is there a provision fund that covers a portion of defaulted loans?

Some platforms offer “buyback guarantees,” where the platform itself buys back defaulted loans after a certain period. I personally gravitate towards platforms with robust risk assessment models and some form of investor protection, even if it means slightly lower returns.

It’s about balancing potential gains with peace of mind.

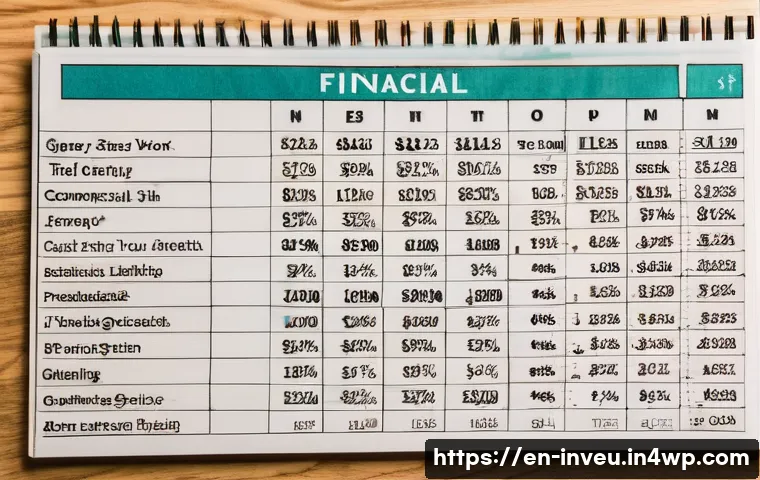

| Risk Factor | Mitigation Strategy | My Personal Experience / Advice |

|---|---|---|

| Borrower Default | Diversify across many small loans; choose platforms with strong credit assessment and collection processes. | Early on, I learned not to over-invest in a single high-interest loan. Spreading out $1,000 across 50 loans of $20 each provides much better protection than putting it all into one. |

| Platform Risk (Insolvency, Fraud) | Research platform longevity, regulatory compliance, and investor protection measures. Diversify across multiple reputable platforms. | I always check a platform’s financial stability and read independent reviews. If a platform seems too good to be true, it often is. I’ve also found comfort in using platforms regulated by financial authorities. |

| Liquidity Risk | Understand loan terms; utilize secondary markets if available; avoid committing funds you might need urgently. | I’ve had to sell loans on a secondary market a few times when unexpected expenses arose. It’s a lifesaver, but sometimes means selling at a slight discount. Plan for longer lock-up periods. |

| Economic Downturns | Invest in different loan types and economic sectors; adjust risk tolerance during uncertain times. | During recessions, default rates can rise. I tend to become more conservative with my investment choices during such periods, focusing on lower-risk, secured loans. |

Optimizing Returns: Maximizing Your P2P Earning Potential

So, you’ve built your sturdy foundation and fortified your defenses – fantastic! Now it’s time to talk about really making your money work hard for you in the P2P space.

This isn’t just about chasing the highest interest rates; it’s about a holistic approach that maximizes your net returns over time. From my own experience, I’ve learned that consistent engagement and smart, strategic adjustments are far more impactful than just a one-time setup.

We’re talking about things like compounding, taking advantage of platform features, and even understanding the tax implications of your earnings. It’s about leveraging every tool in your arsenal to squeeze out every possible penny.

I remember feeling so proud when my monthly passive income started consistently growing, not just from new investments but from the reinvested earnings themselves.

That’s the power of strategic optimization – it turns your initial capital into a self-sustaining growth engine, propelling you closer to your financial aspirations.

It’s an incredibly satisfying feeling to watch your money multiply, knowing you’ve actively orchestrated its growth.

Harnessing the Power of Compound Interest

If there’s one “secret sauce” to long-term wealth building, it’s compound interest, and P2P lending is an incredible vehicle for it. The idea is simple: as you receive interest and principal repayments from your loans, you immediately reinvest them into new loans.

This creates a snowball effect, where your earnings start earning their own earnings. I personally set up auto-invest rules on most platforms to ensure that any funds sitting idle are quickly put back to work.

Even small amounts, when consistently reinvested, can make a monumental difference over several years. It’s like planting a tiny seed and watching it grow into a mighty tree – patience and consistent reinvestment are key.

Strategic Reinvestment and Auto-Invest Features

Many P2P platforms offer fantastic auto-invest features, and I honestly can’t recommend them enough. Once you’ve defined your investment criteria (loan type, interest rate, risk level, diversification rules), the platform can automatically invest your available funds into suitable loans.

This saves you a ton of time and, more importantly, ensures that your money is *always* working for you, minimizing “cash drag” – periods where your money is sitting uninvested.

My strategy often involves tweaking these auto-invest settings periodically, especially if market conditions change or if I want to target specific loan types.

It’s a set-it-and-forget-it system, but with the caveat that you should still periodically review and adjust it to ensure it aligns with your evolving goals.

Beyond the Basics: Tax Planning for P2P Lending Profits

Okay, let’s talk about something that many new P2P investors often overlook until tax season rolls around: the tax implications of your earnings. It’s not the most glamorous topic, I know, but trust me, understanding this upfront can save you a significant amount of headaches and ensure you keep more of your hard-earned profits.

Ignoring taxes is like leaving money on the table, and who wants to do that? My personal journey taught me that proactively planning for taxes is just as important as choosing the right loans.

Depending on where you live and your specific tax situation, your P2P income might be treated as interest income, capital gains, or even business income.

This isn’t just about filling out a form; it’s about potentially optimizing your investment strategy to be more tax-efficient. A little bit of research or a quick chat with a tax professional can make a world of difference in your net returns.

It’s truly an integral part of becoming a savvy P2P investor, allowing you to focus on growth without unexpected financial surprises.

Understanding Income Classification and Reporting Requirements

One of the first things I learned about P2P lending is that your earnings are taxable income. How it’s classified depends on your local tax laws. For many, it’s treated as ordinary interest income, similar to what you’d earn from a savings account.

However, if you’re engaging in high-volume trading on secondary markets, for example, it might even be considered capital gains. It’s crucial to understand how your specific activities are viewed by your tax authority.

Platforms often provide annual statements, like 1099-MISC forms in the U.S., but it’s your responsibility to ensure all income is reported accurately.

I always keep meticulous records of my P2P investments, including all deposits, withdrawals, interest earned, and any losses from defaults, to make tax time as smooth as possible.

Exploring Tax-Efficient P2P Investment Strategies

While P2P lending itself isn’t a dedicated “tax-sheltered” investment in the way a 401(k) or IRA might be, there are still strategies you can employ to be more tax-efficient.

For instance, if you have other capital losses from investments, you might be able to use those to offset some of your P2P gains, depending on your tax jurisdiction.

Another approach, depending on your country’s tax code, could involve investing through specific legal entities if your P2P activities are substantial.

I’m not a tax advisor, but I’ve personally found that simply being aware of the tax implications allows me to think more strategically about when to take profits, when to reinvest, and how to manage my portfolio throughout the year.

Always consult with a qualified tax professional to understand the best strategies for your individual circumstances.

Staying Ahead of the Curve: Monitoring and Adapting Your P2P Strategy

The world of finance, and especially P2P lending, isn’t static. It’s dynamic, ever-evolving, and influenced by a myriad of economic factors, technological advancements, and regulatory changes.

This means that once you’ve set up your P2P portfolio, your job isn’t done. Far from it! To truly thrive and continue generating robust returns, you absolutely need to cultivate a habit of regular monitoring and strategic adaptation.

I’ve personally seen how a hands-off approach can lead to missed opportunities or, worse, unforeseen risks. Economic shifts, changes in interest rates, new platform features, or even a different regulatory environment can all impact your investments.

It’s about being proactive, not reactive, and treating your P2P portfolio like a living, breathing entity that needs occasional nurturing and guidance.

Staying informed and being willing to adjust your course is the hallmark of a truly successful and long-term P2P investor.

Regular Portfolio Reviews and Performance Assessment

I make it a point to review my entire P2P portfolio at least once a quarter, sometimes more frequently if there’s significant market volatility. This isn’t just about checking my account balance; it’s about a deeper dive.

I look at my actualized returns versus my target returns, assess the default rates of the loans I’m invested in, and evaluate the performance of the platforms I’m using.

Are they still meeting my expectations? Have there been any changes in their terms or conditions? This regular check-in allows me to identify underperforming segments or areas where I might be over-exposed to risk.

It’s also a great way to celebrate successes and acknowledge progress toward my financial goals.

Adapting to Market Shifts and Platform Developments

The P2P lending landscape is constantly evolving. New platforms emerge, existing ones introduce new features or change their loan offerings, and economic conditions can shift rapidly.

For example, a sudden increase in central bank interest rates might make certain P2P loans less attractive compared to other investments. I try to stay informed by following industry news, reading expert analyses, and participating in investor forums.

If a platform I’m using introduces a new buyback guarantee, for instance, I’ll assess how that might impact my risk profile and potentially adjust my auto-invest settings.

Remaining agile and willing to adapt your strategy based on new information is absolutely crucial for long-term success in this space.

The Human Element: Building Trust and Community in P2P

Beyond all the numbers, algorithms, and financial planning, there’s a profoundly human aspect to P2P lending that I’ve come to deeply appreciate. It’s easy to get caught up in the analytics, but at its core, P2P connects individuals and businesses with capital, often sidestepping traditional, sometimes impersonal, financial institutions.

This fosters a sense of community and mutual benefit that you don’t always find in other investment avenues. I’ve learned that platforms that prioritize transparency and foster a strong, engaged user base often feel more trustworthy and robust.

It’s not just about earning a return; it’s about being part of an innovative financial movement that empowers individuals. This human connection, ironically, often translates into a more reliable and sustainable investment environment.

When a platform openly communicates with its users, shares insights, and builds a supportive community, it creates a much stronger foundation of trust and reliability, which in turn, protects your investment.

Engaging with the P2P Community and Expert Insights

One of the most valuable resources I’ve found in my P2P journey isn’t a fancy algorithm or a hidden strategy, but the collective wisdom of the P2P investor community itself.

Online forums, dedicated blogs, and social media groups are brimming with experienced investors sharing their insights, asking questions, and warning others about potential pitfalls.

I make it a point to regularly engage with these communities. Hearing about others’ experiences, both good and bad, has given me perspectives that no amount of solo research could.

It also helps validate or challenge my own assumptions and strategies. Furthermore, following reputable financial news outlets and industry experts keeps me informed about broader economic trends that could impact the P2P market.

Leveraging Platform Transparency and Support Systems

A truly good P2P platform understands the importance of transparency and investor support. I’ve always gravitated towards platforms that provide clear, detailed information about their loan books, borrower statistics, default rates, and financial health.

When a platform is open about its operations, it builds a massive amount of trust. Equally important are accessible and responsive customer support systems.

There will inevitably be questions or issues that arise, and knowing you can get timely and helpful assistance makes a huge difference. My best experiences have been with platforms where I felt genuinely supported and informed, not just treated as another number in their system.

This commitment to transparency and support is a strong indicator of a platform’s long-term viability and ethical standards.

Wrapping Things Up

And there you have it, folks! What a journey we’ve been on, from charting your financial goals to mastering the nuances of P2P lending. My biggest takeaway from years in this space is that success isn’t about chasing fleeting trends or blindly following others; it’s about building a robust, personalized strategy rooted in informed decisions and continuous learning. I truly believe that with the right mindset and the practical tips we’ve discussed, you’re more than ready to navigate the P2P landscape with confidence. Remember, every step you take, every loan you fund, is moving you closer to financial empowerment. Keep learning, stay vigilant, and most importantly, enjoy the incredibly rewarding process of watching your investments grow.

Useful Information to Know

1. Start Small and Scale Gradually: Don’t feel pressured to invest a large sum right away. Begin with a modest amount, learn the ropes, and as you gain confidence and understanding, you can gradually increase your investment. This “crawl, walk, run” approach minimizes initial risk.

2. Treat P2P as Part of a Diversified Portfolio: While P2P lending offers attractive returns, it should ideally be one component of a broader investment strategy. Don’t put all your eggs in this basket; balance it with other asset classes like stocks, bonds, or real estate for overall portfolio resilience.

3. Monitor the Global Economic Climate: P2P lending, like any financial market, is influenced by broader economic conditions. Keep an eye on interest rate changes, inflation, and employment figures in major economies, as these can impact borrower default rates and investment opportunities.

4. Read the Fine Print (Always!): Every P2P platform has its own terms and conditions, fee structures, and default handling procedures. Before committing your funds, take the time to thoroughly read and understand these details. It’s boring, but it’s absolutely essential.

5. Set Realistic Expectations: While P2P lending can offer higher returns than traditional savings accounts, it’s not a get-rich-quick scheme. Understand that defaults can occur, and returns can fluctuate. Focus on consistent, long-term growth rather than expecting overnight riches.

Key Takeaways

P2P lending offers a fantastic avenue for passive income and portfolio diversification, but thoughtful strategy is paramount. Define clear financial goals, conduct thorough platform due diligence, and relentlessly prioritize diversification to mitigate risks. Remember to leverage compound interest and smart reinvestment while staying informed about tax implications and market changes. Your journey to P2P success is a continuous process of learning and adaptation, ultimately leading to a more robust financial future.

Frequently Asked Questions (FAQ) 📖

Q: So, P2P lending sounds great, but honestly, what are the real risks, and how can I actually protect my money?

A: This is probably the number one question I get, and it’s a super valid one! When I first dipped my toes into P2P, I was definitely a bit wary, and you should be too – informed caution is your best friend here.

The biggest risk, hands down, is borrower default. It’s a bummer, but some folks just won’t pay back their loans. My personal strategy?

Diversification, diversification, diversification! Don’t put all your eggs in one basket, ever. Instead of one large loan, spread smaller amounts across many different borrowers, loan types, and even multiple platforms.

I’ve found that investing just $25 or $50 into a hundred different loans drastically reduces the impact if one or two go south. Think about geographical diversification too if your platform offers it – different economies, different risks.

Also, really dig into the platform’s risk assessment tools. Some platforms, thanks to AI, are getting incredibly sophisticated at vetting borrowers, but it’s still your money on the line.

I always scrutinize their loan grading system and historical performance data. If a platform is shy about sharing those numbers, that’s a red flag for me.

Lastly, start small. Invest an amount you’re comfortable losing initially, learn the ropes, and then gradually scale up as you gain confidence and understanding.

Trust me, slow and steady truly wins the race in this space!

Q: What kind of returns can I realistically expect from P2P lending, and how does it stack up against, say, the stock market or a savings account?

A: Ah, the million-dollar question – or rather, the “how many dollars can I make” question! This is where P2P lending really shines for many of us. While returns can vary widely based on the platform, loan types, and the risk you’re willing to take, I’ve personally seen average annual returns ranging from 5% to 15%.

Yes, you read that right – 5% to 15%! Compared to a high-yield savings account that might give you 0.5-2% on a good day, it’s a whole different ballgame.

And while the stock market can offer higher potential returns, it also comes with significantly more volatility and often requires a deeper understanding of market trends.

What I love about P2P is that the returns are often more consistent, especially if you’re diversifying well. It’s not about getting rich overnight; it’s about generating a steady stream of passive income that can genuinely outpace inflation and contribute meaningfully to your financial goals.

I view P2P as a fantastic middle ground: more reward than traditional savings, but often less rollercoaster-like than direct stock investing. Just remember, higher potential returns usually come with higher risk, so always balance your expectations with your comfort level.

Q: With so many P2P platforms out there, how do I even begin to choose the right one for my investment goals?

A: This is another crucial one, and honestly, the landscape is constantly changing, which is both exciting and a little overwhelming! It’s not just about picking a platform; it’s about finding the right fit for you.

When I’m evaluating a new platform, the first thing I look at is their track record and transparency. How long have they been around? What are their default rates?

Do they clearly explain their fee structure? A platform that’s upfront about its successes AND its challenges usually earns more of my trust. Then, I dive into the types of loans they offer.

Are you looking for personal loans, business loans, real estate, or something else? Different platforms specialize in different niches. For instance, if you’re interested in real estate, a platform like Fundrise or RealtyMogul might be perfect, whereas for consumer loans, LendingClub or Prosper could be your go-to.

I also pay close attention to the platform’s liquidity options. Can you sell your loans on a secondary market if you need to access your cash? This flexibility can be a huge advantage.

And don’t forget the user experience! Is the platform intuitive and easy to navigate? Are their customer support options robust?

After all, you’ll be spending time on it, so it should feel good to use. My advice? Do your homework, read independent reviews (not just the ones on their site!), and maybe even start with a smaller investment on a couple of different platforms to see which one you prefer before committing larger sums.

It’s like test-driving a car – you wouldn’t buy one without taking it for a spin first, right?